Life insurance is meant for your dear ones after you. It will be financial support for your family. There are verities of insurance plans available, each type of life insurance plan designed to fulfill various expected life insurance needs. Understanding its concept will help you buy the best suitable plan.

You put your money to buy life insurance however you must invest your time in your health, good health is wealth.

Insurance is a big expenditure; do not let emotions take decisions, checking things with a practical approach will help.

- Is your family dependent on you?

- Debt obligations

- Financial protection

- How much money you can afford?

What are the types of life insurance?

1. Permanent insurance

a. Whole Life

b. Universal Life

- Guaranteed universal life

- Indexed universal life

- Variable universal life

2. Term Insurance

- One Year Renewable (increasing every year)

- Level Premium (convertible)

Permanent life insurance | Whole life insurance

Permanent /Whole life insurance provides lifelong insurance plus it is a wealth-building plan. Premium payment goes to build cash value and another part goes to insurance. The policy premium remains constant, your beneficiary gets tax free death benefit.

Universal life insurance

is a mix of whole life and market index

Guaranteed universal life

Has fixed premium. Even if market index does not perform policy will not laps, guaranteed coverage is provided as long as premium is paid.

Indexed universal life

Has flexible premium. Cash value Interest rate depends on a market index such as S&P 500.

Variable universal life

Has flexible premium, cash value is invested in sub-accounts that can contain stocks and bonds hence cash value can go up or down. An investment portfolio requires to be managed by the policy owner.

Cash value and death benefits depend on the portfolio’s performance.

Check more on Universal life insurance

What you don’t know about Universal Life Insurance

Term insurance

Insurance is for a fixed term; no cash value is accumulated and premium is paid only for death benefits. This is the cheapest insurance available.

Level Term / Level Premium

This is the most common term insurance. It has fixed premium and fixed death benefits; the beneficiary gets tax-free death benefits if the policyholder dies while the policy is in force.

Yearly Renewable

It is not a very attractive choice; the policy has no fixed term and requires to renew every year. Premium changes every year.

Decreasing Term

Premium remains constant, death benefit decreases every year, and it is generally matched with a mortgage.

Life insurance renewal checklist

Most Term policies are renewable, it can be renewed when the term is nearing to end, even if your health condition is not the same.

Check with your insurer before the policy expires.

- At what premium it is allowed to renew?

- At what age it cannot be renewed?

- Is medical examination required for renewal?

- Check death benefits are the same

- Recheck policy beneficiary

- What is the grace period for renewal?

- What happens in case of major life changes?

Policy premium should not add a burden.

Do not invest big amount in one policy to reduce any unfavorable situation.

Do not invest in one plan, instead plan small multiple insurance plans.

Change beneficiaries in time when required

Review your finances and policies every year-end and at the start of the new year. Beneficiary change is required when there is a major change/event in your life.

Life Insurance Policy Locator Service | Unclaimed life insurance policy

If you don’t know insurance policies of a deceased family member and you are likely beneficiary then you can locate insurance policies and annuity contracts of a deceased family member or close relationship by requesting online at NAIC portal, it is a free service.

Life settlement | How to sell my life insurance policy?

You can sell your life insurance policy; it is called Life Settlement. You need to find a broker or insurance settlement company, they charge fee to find buyer, you don’t need to pay premium once sold and you will get a lump sum amount in exchange, make sure you get a better in-hand price than the surrender value.

Surrender charges

Most policies have surrender charges when you want to opt-out of the policy agreement. Charges are higher in the initial policy years and keep reducing every year. While buying any policy, check its surrender charges and what you get when you surrender. This will also help you understand which policy to buy. You can also surrender a fully paid policy.

Conversion benefit

While buying term insurance check whether the policy conversion to permanent whole life insurance or annuity plan or equivalent is allowed and at what age conversion is allowed.

What is section 1035 exchange?

IRS tax code Section 1035 allows existing life insurance or annuity policy fund transfer to a different life insurance or annuity contract without paying tax.

How to change policy status to paid in full?

Applicable to whole life insurance, if you don’t want to pay future premiums then there is an option to change policy status to paid-up with reduced benefits.

Insurer will adjust the death benefit and cash value so that there is no need to pay premium and reduced benefits will continue for life.

It is better to compare with surrender charges.

Is permanent life insurance bad investment?

Investment and insurance are different like apple and orange. You will never get a desirable returns in permanent life insurance plans, but if you want to grow your money then you must change your route.

For insurance, you must think about buying level-term insurance plan which will be available at a lower price for the same amount of death benefit.

Rest of the money you can invest in mutual fund or in stocks where you will get good returns. Provided you invest time in buying and understanding it. For example, Apple stock has grown over 250% in the last 5 years (in Jan 2018 it was at $43.75 and in July 2022 it is at $162.51)

Permanent life insurance AARP

AARP provides life insurance from New York Life to members with no medical exam.

About New York Life is financially healthy and one of the best-rated company.

You must get AARP membership; yearly membership will cost around $ 12 to 16.

AARP offers a lower coverage limit around $100K for term and $50K for permanent life insurance.

It is best for older people with no medical examination.

Permanent life insurance tax benefits

Life insurance is not mandatory, there is no tax benefit on the life insurance premium you pay. However, death benefit received by the beneficiary is not taxable but interest on proceeds is taxable.

If you have surrendered life insurance policy and if the proceeds paid to you is less than the cost of insurance then the proceeds is not taxable.

If the proceeds you received is more than the cost of insurance then calculate taxable proceeds as below.

Taxable Proceeds = (Proceeds) – (Cost of insurance)

Cost of insurance = (Total premium paid) – (refunded premium) – (rebates) – (dividends or unpaid loans which is not included in income)

Maturity benefits are tax-free. It may attract tax if you receive it in parts.

Permanent life insurance rates by age | Life insurance buying checklist

Youngers do not have major health issues; insurance companies see lesser risk covering youngers hence insurance rates are cheapest for them. As you grow old risk increases so does the insurance cost.

It is better to get insurance at a younger age. The minimum age to get a life insurance policy is 18 Years.

Insurance is required for unhealthy people as they are uncertain about their life but in contrast, it is difficult for them to get Insurance.

It is very easy for healthy people to get insurance. Check out general questions asked while buying insurance.

- Tobacco product use?

- Major illness or being treated for?

- Asthma

- Depression

- Heart Attack

- Stroke

- Cancer

- Diabetes

- Sleep Apenea etc.

- Behavior-related questions like good driving history and no suspension of license is essential.

- Risky hobbies

Skydiving

Scuba diving

Mountain hiking

Car racing - Dangerous occupation: Pilot, firefighters, etc.

Depending on the above answers premium is decided or even insurance can be denied.

Does permanent life insurance be denied?

While declaring about your health make sure it is matching with your health records. Hobbies, and profession-related questions should be answered carefully as it may create issues while claim settlement sometime even claim can be rejected. Better to check your offline and online social media history.

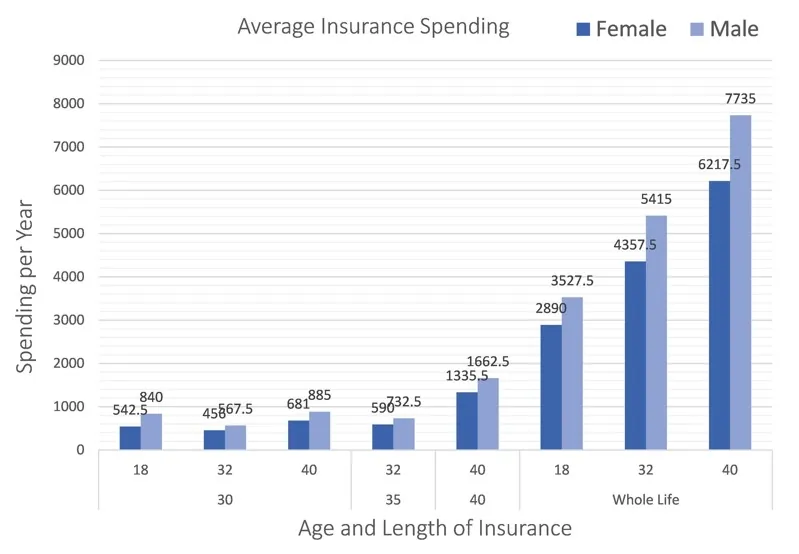

Average insurance spending per year for coverage of $ 500,000 | Women have lesser insurance bill than men

| Age | Gender | Policy Length in years | Average yearly Cost $ |

| 18 | Male | 30 | 630 to 1050 |

| 18 | Female | 30 | 385 to 700 |

| 18 | Male | Whole Life | 3480 to 3575 |

| 18 | Female | Whole Life | 2860 to 2920 |

| 32 | Male | 30 | 380 to 755 |

| 32 | Female | 30 | 320 to 592 |

| 32 | Male | 35 | 485 to 980 |

| 32 | Female | 35 | 405 to 775 |

| 32 | Male | 40 | 690 to 1200 |

| 32 | Male | Whole Life | 4830 to 6000 |

| 32 | Female | Whole Life | 4300 to 4415 |

| 40 | Male | 30 | 625 to 1145 |

| 40 | Female | 30 | 482 to 880 |

| 40 | Male | 40 | 1345 to 1980 |

| 40 | Female | 40 | 1075 to 1596 |

| 40 | Male | Whole Life | 7500 to 7970 |

| 40 | Female | Whole Life | 6010 to 6425 |

As of 2020 average life expectancy of USA citizen is

- Male 74.2 years and

- Female 79.9 years.

Leading and common Cause of death is

- Heart Disease

- Cancer

- COVID-19

- Stroke

- Chronic Lower respiratory Disease

- Alzheimer Disease

- Influenza and pneumonia

- Kidney disease.

Group Insurance

Employer can negotiate a contract with insurance company for insurance need of their employees and common agreement is made. Depending on age group coverage is provided for which some employer pays for employees and in some paid by employees but it is at a much lower rate than what is paid for individual insurance.

Generally, term and health insurance and in some cases pet insurance is also provided by employers.

Employees can add their children and spouse without any medical examination and no waiting period required; this is simple and easiest method.

Life Insurance Military

The U.S. Dept. of Veterans Affairs VA program provides term life insurance to all active-duty members, retirees and their family members with coverage up to $ 400,000 at a very low cost however for most families it might not be sufficient, it can be supplemented with additional insurance other than VA.

Many companies offer insurance to active-duty members and their families.

Life Insurance Rider

Riders are the extra benefits provided along with policy benefits, to customize your policy. It comes with additional cost in policy premium. Riders are optional, one can opt more than one rider in a policy.

Permanent life insurance tax change | What is section 7702?

Internal Revenue Service (IRS) of U.S. has defined life insurance contract in section 7702 for tax calculation purpose to decide whether income from contract should be given life insurance proceed treatment or ordinary income treatment.

To find out nature of income IRS has defined two tests. Policy should pass below test

Cash Value Accumulation Test (CVAT)

If policy holder wants to surrender the policy, then net amount received by policy holder should not be greater than net single premium (single lump sum premium to purchase same policy)

OR

Guideline Premium and Corridor Test (GPT)

Policy holder should pay policy premium as per requirement specified in contract. It should not be over funded any time during contract.

Death benefit should always be greater than applicable percentage of surrender value.

If policy holder continues to pay as per contract requirement, then they need not to worry.

Policy should pass either of the above test to get life insurance tax benefit else it will be treated as ordinary income for that year for tax calculation.

What has changed in section 7702?

In December 2020 congress passed revision to IRS section 7702 to reduce interest rate; section 7702 was introduced in 1980

This will affect cash value and premium.